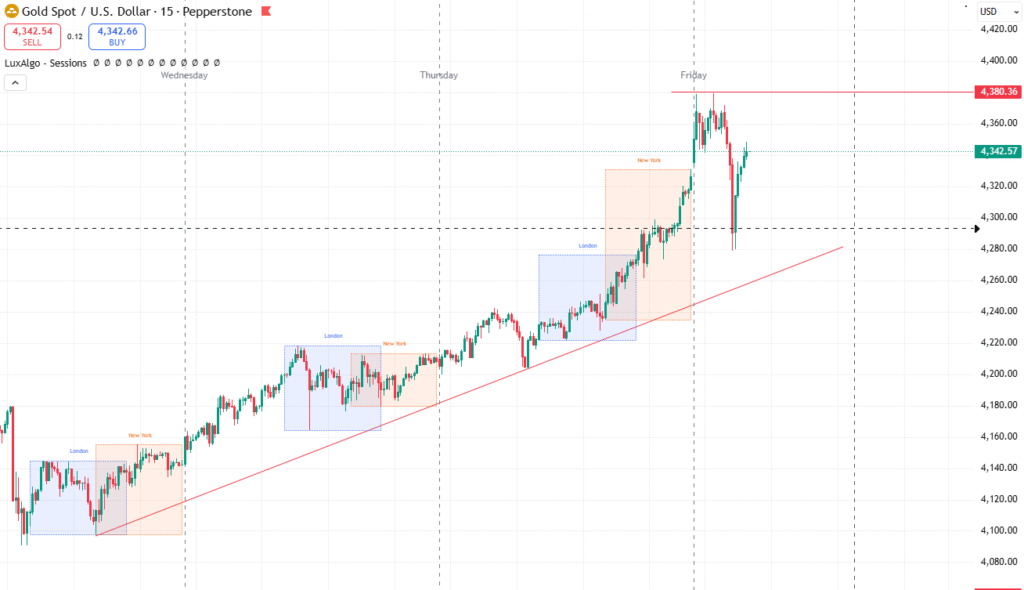

Why Gold Surged to Around $4,380/oz This Morning

Recent market news indicates that gold prices soared past $4,300/oz — some reports even suggest opening levels near $4,380/oz, marking a record high. Several key factors likely contributed to this sharp rally:

1. Expectations of U.S. Federal Reserve Rate Cuts

Many investors believe the Federal Reserve (Fed) will soon cut interest rates amid signs of economic slowdown and a weakening labor market.

Lower interest rates reduce the opportunity cost of holding gold — a non-yielding asset — making it more attractive.

2. Geopolitical Tensions and Global Uncertainty

Heightened tensions between major powers (particularly China and the U.S.) and ongoing regional conflicts have pushed investors toward “safe-haven” assets like gold.

Whenever global stability is in question, gold tends to benefit from capital inflows.

3. A Weaker U.S. Dollar

Since gold is priced in U.S. dollars, a weakening USD makes gold cheaper for buyers using other currencies — boosting demand and pushing prices higher.

4. Risk-Off Sentiment and Capital Flight to Safety

When financial markets show volatility or fear of recession rises, institutional investors and funds often rotate into gold — including gold ETFs and central bank purchases.

This collective move significantly amplifies gold’s upward momentum.

5. Uncertainty Around Economic Data Releases

In cases where important U.S. economic indicators (such as inflation, jobs, or GDP) are delayed or unclear — possibly due to administrative disruptions — investors turn to gold as a hedge against uncertainty.