Hello traders, welcome back — this is your fresh take on XAU/USD as of today.

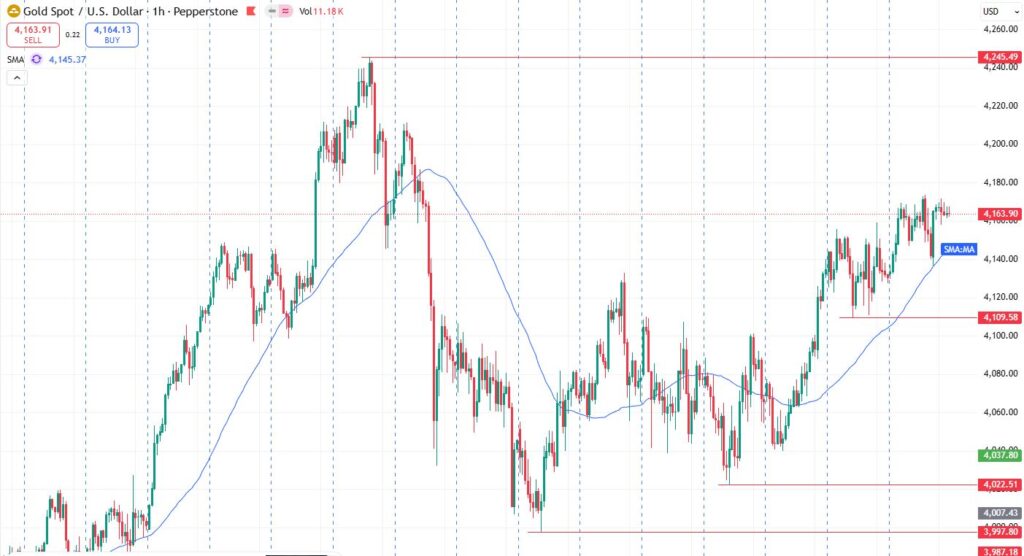

Right now, spot gold has climbed to roughly USD 4,164.76/ounce — up about +0.54% in last 24 hours.

That rise comes amid growing market expectation that the Federal Reserve (Fed) could cut interest rates soon — a dynamic that tends to weaken the USD and boost demand for non-yielding assets like gold.

Just yesterday, gold hit a fresh one-week high as rate-cut bets surged: spot gold jumped ~0.8%, and futures also saw gains.

Analysts note that the probability of a December rate cut is now pricing in at roughly 85%, up sharply from just ~30% a week ago.

On the flip side, if upcoming U.S. economic data — jobs, inflation, yields — come in stronger than expected, or if the USD rebounds, gold could face pressure. Real yields rising or hawkish comments from the Fed often hurt gold’s appeal, since gold doesn’t earn interest.

Also worth noting: long-term forecasts are bullish. Some major institutions expect gold to continue rallying into 2026 and 2027, driven by continued central-bank buying, geopolitical uncertainty, and weakening confidence in fiat currencies.

So — what to watch in the next 24-48 hours: key U.S. economic data releases (inflation, labour market), any Fed-related comments, and shifts in U.S. dollar strength or global risk sentiment.

If you want regular updates with data + chart + trade ideas on XAU/USD, Smash that Like, hit Follow, and comment “GOLD” so I know to drop the next breakdown for you. Trade safe — see you next update.