“Hey traders! Welcome back to your oil market briefing — and this week, crude oil is moving under a powerful mix of supply pressure, geopolitical tension, and major market catalysts. Let’s break down everything you need to know in just two minutes.

Right now, oil prices are trading under pressure, but volatility is picking up fast. On the bullish side, geopolitical tensions have increased, especially with recent attacks on energy infrastructure and conflict risks across key supply regions. These events create a risk premium, pushing oil higher as traders price in the possibility of supply disruption.

At the same time, OPEC+ remains a major driver. The group decided to hold output steady into early 2026 and introduced a brand-new quota-setting mechanism to evaluate sustainable production capacity. This move encourages long-term investment and can support oil prices if global supply tightens.

But on the bearish side, global supply continues to outpace demand. Analysts expect oversupply to stretch well into 2026, especially as certain producers gradually reopen capacity. Combine this with slower economic growth across Europe, China, and emerging markets — and demand outlook stays weak. That limits the upside for crude prices.

Now let’s talk about the key trading factors you should watch closely this week:

Firstly — Supply vs demand balance. Oil reacts instantly to any shift in production or consumption outlook. Rising supply tends to push oil down, while rising demand pushes it up.

Secondly — The U.S. dollar. Oil is priced in USD. A stronger dollar normally pulls oil lower, while a weaker dollar can lift prices.

Thirdly — U.S. crude inventories. Weekly EIA and API reports can cause sharp moves. Large inventory draws are bullish, and big builds are bearish.

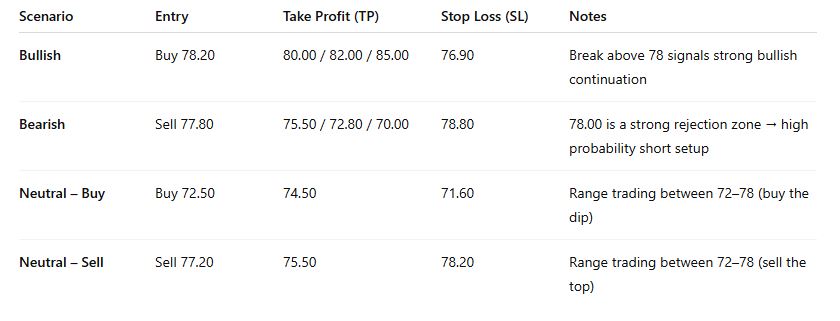

Fourthly — Technical levels. Watch support around $72, $70, and $67, and resistance near $78, $82, and $85. A breakout from these zones often produces clean, directional momentum.

Fifthly — Market sentiment and hedge fund positioning. Extreme positioning can trigger short squeezes or long liquidations.

And finally — timing matters. Oil moves strongest during U.S. market open, during inventory releases, and during geopolitical headlines. These windows offer the biggest opportunities — but also the highest risk.

So here’s the takeaway:

Oil is stuck in a tug-of-war. If geopolitical tension escalates or OPEC+ tightens supply, prices could rebound quickly. But if global demand stays weak and inventories keep rising, oil may drift lower toward the $70 zone.

Stay alert, watch the data, and manage your risk — because in the oil market, news can flip the trend in seconds.

If you want more daily oil outlooks, hit follow, drop a like, and comment ‘OIL’ for the next update. Trade safe, and see you in the next briefing.”